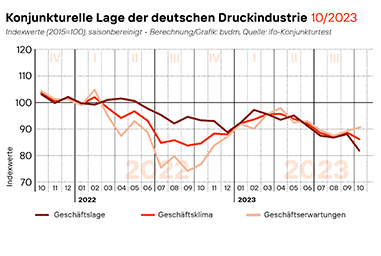

In October 2023, the seasonally and calendar-adjusted business climate in the German print and media industry fell again. While the business outlook for the next six months rose slightly, assessments of the current business situation collapsed. The business climate index calculated by the German Printing and Media Industries Federation fell by 2.8 per cent compared to the previous month, adjusted for seasonal and calendar effects. At 86.4 points, the index was around 1.8 per cent above the previous year’s level, but reached a new low for the year. Companies’ business situation continues to be burdened by persistently weak demand and below-average capacity utilisation.

In October 2023, the decision-makers at printing and media companies surveyed by the ifo Institute assessed their current business situation as significantly worse than in the previous month. In contrast, they were slightly less pessimistic about developments in the coming months. Expectations regarding business development over the next 6 months increased. However, the slump in the business situation predominated in October and the business climate therefore fell significantly compared to the previous month. The characteristics of the current and expected business situation determine the development of the business climate, which is a good leading indicator for production development in the print and media industry.

The seasonally and calendar-adjusted business situation index recorded a significant decline in October and, at 82.1 points, was around 7.0 per cent lower than in September. At around 12.2 per cent, the index was thus significantly below the previous year’s level. Around 62 per cent of the companies surveyed stated that they had been affected by production restrictions in October. With a share of 53 per cent, the lack of orders remained the biggest obstacle to production. The persistently low order situation was also reflected in the utilisation of operating capacities. In October, the companies surveyed recorded an average capacity utilisation rate of around 77.3%. This is around 2.6 percentage points lower than in the previous year. Assessments of the order backlog also remained clearly negative with a balance of -51.9 percentage points.

Print and media companies were slightly less pessimistic about their expected business development over the next six months than they were about their current situation. At a seasonally adjusted 90.9 points, the index was around 1.6 per cent above the previous month’s level. However, only a few companies (13 per cent) still stated that they expected their business situation to improve significantly over the next six months. Around 43 per cent of respondents expected their business situation to deteriorate over the next 6 months.

Background information on the bvdm economic telegram and information on participating in the monthly ifo economic surveys can be found at: bvdm-online.de/kt

BVDM

The Bundesverband Druck und Medien e. V. (bvdm) is the umbrella organisation of the German printing industry. As an employers’ organisation, political business association and technical trade association, it represents the positions and objectives of the printing industry vis-à-vis politicians, administration, trade unions and the supplier industry. The bvdm is supported by eight regional associations. Internationally, it is organised through its membership of Intergraf and FESPA. The printing industry currently comprises around 6,900 predominantly small and medium-sized companies with more than 110,000 employees subject to social security contributions